MSTR post-mortem

I'm traveling tomorrow to California and have to get ready for that so I might not have time for a proper post on the main blog. Here are my results on MSTR parabolic short yesterday.

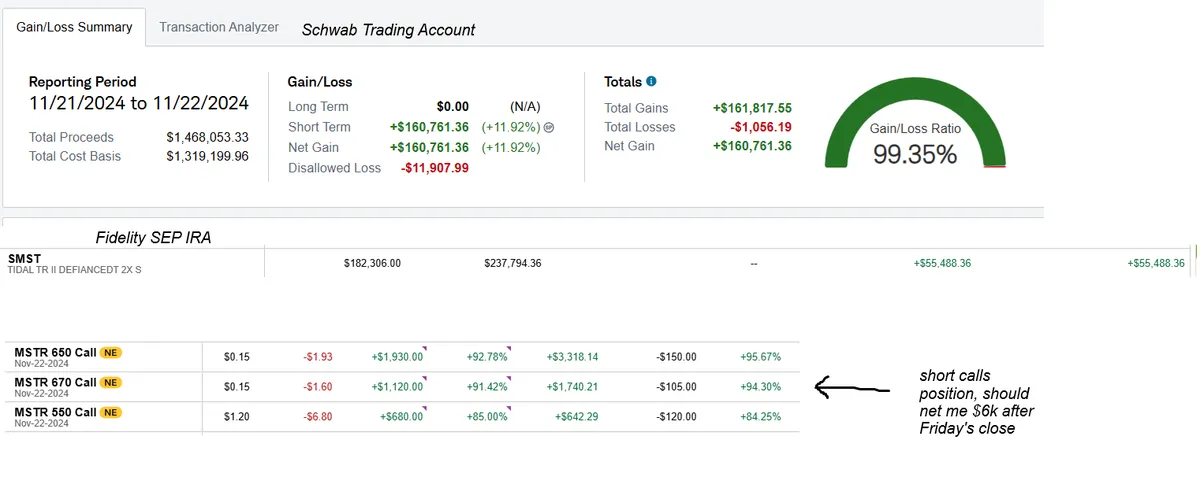

So all-in-all, $221,000 net. I'm pretty pleased with the result. Some things could have been better (more on that below) but fundamentally, I nailed the 3 core aspects of this trade, outlined below:

- Not losing money on the way up

- Size on the day it turns

- Holding for key targets

Point numero uno is the key. Some people can take drawdown and keep adding and survive, some can take a lot of papercuts while guessing and still be ready for the day of the turn, that's fine and I've been that guy on different trades, but in my current mindset, those approaches are a NO for me.

Alright, so let's break down the trade. I had a high level of confidence going into the day that today was the day and you can view my previous posts for that. As far as mapping out entries, I wasn't super fixated on any specific entry, I just wanted to get in. I was sorta thinking red from the bell but I also wanted to see if it wanted to be strong off the bell in case my timing was off. Dealing with that uncertainty of not knowing the exact setup but also not wanting to depend on an exact setup--that's difficult but I feel I have gotten better at just figuring it out on the fly and trusting myself. It only took a decade of experience to do that.

9:30 -- I bought 30 $470 puts expiring Friday on Scwab, at cost of 13.65.

9:40ish -- I sold 800 MSTR short on Schwab at 519, had a bad micro entry that immediately took me red within a minute up to 535 but for some reason, I didn't feel as worried as I normally do. I did bid out of 100 shares when it came back to my entry, so I took 700 down into the 500 wash. IDK why I do that, old habit.

9:50ish -- I bought 45000 shares of SMST at 4.07, an inverse 2x MSTR ETF, in my SEP IRA. I wanted to buy 55000 to be full port but Fidelity was giving me order issues about 50k orders so I had to tranche my orders into 20k orders which cost me some time (I had some unfilled limits at 4.04).

My targets were 475 (First gap fill), 450 (whole number), 430 (PRIMARY TARGET and second gap fill), and then 400 and below for bonus money.I was very confident that we'd hit 430 but I covered slivers at 450-475 anyway because that's my piker side. I think my average sale basis of SMST was 5.25 across 3 tranches. Remember my first post, I said 380 was PERFECT day 1 target right? Had no shares by that point oh well.

We drop out clean. I didn't stress over the wide 1min micro bounces it had. 430 I cover most and lock in low six figs--maybe 100,000 total across MSTR/SMST, and left 20 of the 470 puts on. I think my PNL peaked just short of 200k there.

Then there's a big bounce, it goes from -10% to +2%. I'm sure the hindsight artists will say it just rejected VWAP there or whatever, but it felt uncomfortable there for sure. I did not want to get frustrated chopping up the bounce so I only re-shorted 200 shares of MSTR and traded around it... ultimately stoppped out over 480 for close to break even and gave up on trying to be a hero and put risk back on. IMO this is the biggest short coming of my trade, it was here where I failed to capitalize properly on the second leg

If you remember my SMCI trade, I did the same thing. I started overthinking and worrying about my unrealized PnL coming back on an options position, I started thinking about btc going to 100k and MSTR gapping up Friday and the IV crush and all that... none of that happened. Weak stock continued to be weak and it died into the close. I even told Clockwork that I shouldn't sell my puts on the re-test of lows, I should let it wipe out the lows, but because I was fixated on the thought of I should have flatten'd into the first wash into primary 430 target, I sold puts at 40-50 and had only 10 left for the 2nd leg. This is my perfectionist side coming out. I sold my last 10 at 69 and 74 respectively (around 400-405 range on the stock). Then they peaked at 90. I used to think inflated IV puts weren't the best strategy for these parabolic plays (probably aren't when it comes to optionable small/mid caps but they've been great for large cap) but that's a nice move and there was never a big IV crush that I'm always worrying about. I should have put those options in my retirement account too, that's another mistake.

Reflecting on all that--overthinking and not properly crushing the easy second leg... it just seems like when things are fast and confirming the initial turn, I can stomach the swings. Then when things slow down and settle, I start going into my own head and fixating on mistakes instead of thinking about WHATS GOING TO HAPPEN NEXT? It didn't feel appealing to be up near 200k and then maybe finish low 100k if my options went to 0 and that became my obsession rather than focusing on what will happen next. Mentally I just wanted to accept my win as quickly as possible rather than being aggressive or greedy.

All in all, I won't be too hard on myself because I nailed the 3 fundamental tenets of the trade. Of course things could be better but that's always that the case on your best winners. I'm a low frequency, low pain tolerance guy now so just being in versus missing it is a massive win, every time.