Lagging Signals.

I have a term that's I'm writing about. I call it lagging signal or cookie cutter entries. Some might just straight up call it chasing.

This will become clear in the next post on main blog. Let's talk about 2 traders. The systems trader and the scalper/discretionary trader.

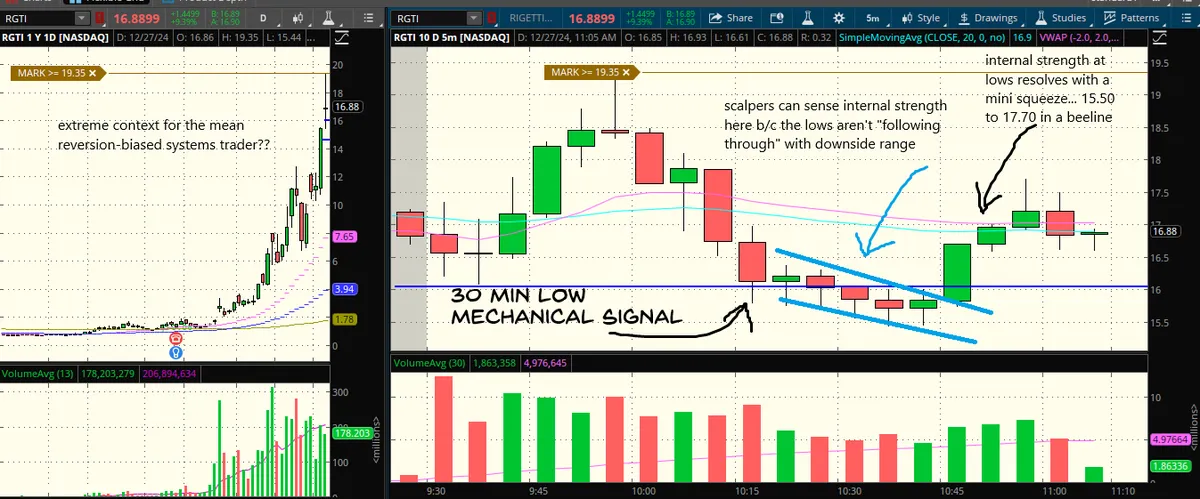

A mechanical signal happens for the systems trader whose strategy revolves around short-biased mean reversion trading. He backtested a cookie cutter signal called "30min low". The systems trader hits the bids on 30min low. His data set suggests that 30min low entry on this mean reversion strategy will lead to his pre-defined target 88% of the time, which is a good win rate.

The scalper can feel that the lows aren't creating anymore speed to the downside. Every new low in the $15-16 range feels "sticky" because it refuses to flush for a good cover for the scalper. This stickiness is hard money for shorts compared to 1-2 pt spillover candles that were previously seen from the 19 to 16 move. One side, the bear side, is getting bottom heavy with their prices--and that includes the systems trader who short the stock 16. The scalper gets long above 16 and the stock "resolves" the bottom heavy price channel with a small squeeze. It goes up 2 clean points and the systems trader is immediately out of the money on his initial entry. It no longer feels likely that there will be an equivalent 2 point downside move from his lagging 16 entry price, at least not immediately. So now he has a dilemma--add into strength and take on the risk of adverse selection (where you are bigger into the strong stocks that give you so-called 'favorable prices' and then fail to hold countertrend signal) or just take a wide stop and sit in a position of weakness for hours?

What happens next--who knows? I've seen it go lower. I've seen it hold up for sideways direction. I've seen it go to new highs. The systems trader will trust his data. The scalper will play it move to move.