Bear thesis

"I don't believe in timing the market!"

That's what I tell everyone who asks me about the market. Why? Because the everyday Joe in your family is usually thinking more long-term than you are, Mr. Daytrader. They don't just shake the coins out of their 401k and then change their minds tomorrow. Timing the market is bad and none of us know anything, ever, so it's best to just get your "guaranteed" 7% avg annual return by being a long-term holder of SPY/QQQ/VOO/VTI. I make my money with individual stock strategies, not by timing the market.

BUT. That said... there are times when it doesn't seem like risk-reward is in the investor's favor. And it might make sense to sit out or raise whatever cash you can (without trigger tax events, which can punish you if you rebuy at the wrong price). I think this is one of those times. I should have realized this sooner but we got a gift of a bounce to at least let me sleep at night knowing I didn't puke dead lows.

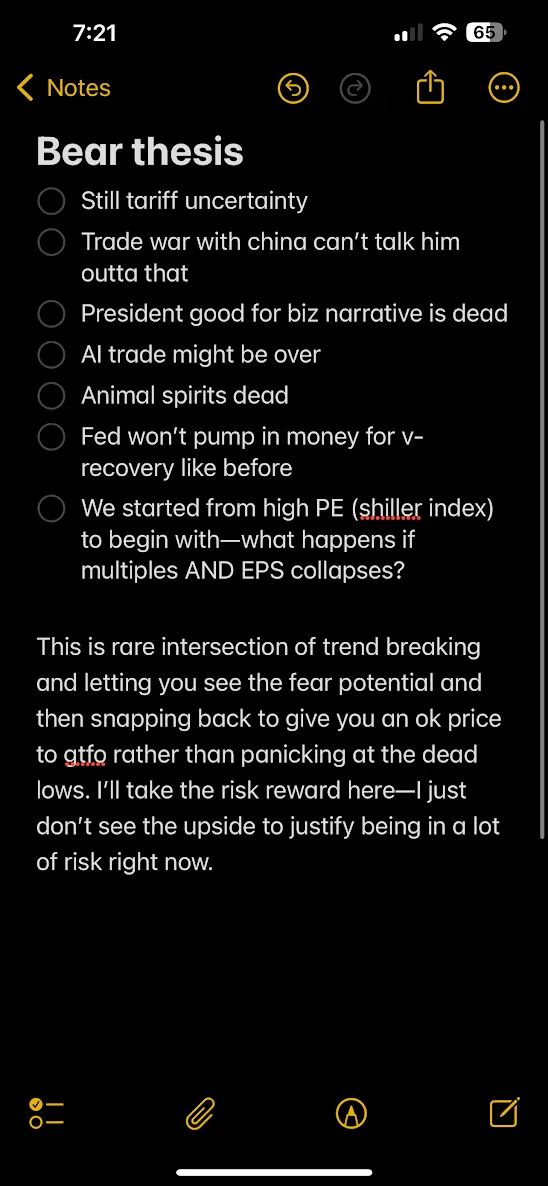

Here's a little bear thesis I punched in on Notes yesterday. Simple bullet points.

Another bullet point I want to add and this is deliberately spiteful on my part... the worst people in the world don't get to celebrate that bounce as if it's over and there's no more pain ever again. Bear markets don't end in panic buying like that. You know the people I'm talking about. David Sacks. Bill Ackman. Fuck those guys.

That doesn't mean go short. That doesn't mean sit out of the market forever. It doesn't mean SPX 3000 is the downside target. It just means... I'm raising cash and being cautious for 6-12 months, maybe even 3.5 years if I don't like how things are going. If everything is ok and not as bad as I fear, then I buy back 5-10% higher and it's not a big deal to me. Yesterday in my post I said I trimmed 15%, then in the afterhours, I upped that amount to 22%. Anything beyond that is unpalatable for me, tax-wise. This is the first time since becoming a long-term index fund investor in 2018, that I've sold a significant amount based on a gut call. We'll see what happens, good luck to you.